Fusing social media and online sports betting may big a significant trend right now, but James Seils and Greg Kajewski had the big idea about two years before everyone else. They just came at it from another direction. And on a more difficult path.

Now, the founders and top executives at BettorEdge, a social media platform that facilitates exchange wagering, hope they can exploit this new hot ticket in the industry as major players begin pouring resources into the communal-experience aspect of the sports betting experience.

“To have the opportunity and foresight to think about the social two years ago was a little bit of luck,” Kajewski (pictured below, upper left) said. “But we feel nicely primed and we’re really looking forward to this football season.”

Primed, they hope, because they’re underway in every state.

Because BettorEdge is not a sportsbook and therefore not subject to the laws that govern them, it can operate in states where sports betting is not legal. Revenues are generated through ad sales and premium tiers. A conduit for real-money wagering in 46 states, BettorEdge remains a Midwest company at its core, though, spawned at the University of Minnesota Sportradar Innovation Challenge in 2019.

With its headquarters in Minneapolis and marketing efforts centered mostly in the upper Midwest – where traditional sports betting is legal in Michigan and Iowa – BettorEdge announced in July that it had exceeded $3.5 million in exchange orders since its launch in January.

The BettorEdge origin story

Seils is the tech guy, a product of the University of Iowa, Majewski a risk and compliance specialist who studied at Northern Iowa. They met at a training seminar in Dallas after being hired by the same company, PwC, in 2019. Seils’ interest in emerging technology and his part-time wagering activities with friends would soon overlap amid reams of spreadsheets.

“I started taking all of that data, spreadsheets and started building smart apps, web apps, and mobile apps,” Seils said. “That’s really how my IT passion sort of connected back to betting. And then to build these apps, I needed data. So I started subscribing to data companies to get free access to data. They all have these free tiers and stuff. And eventually one of them reached out to me to join an innovation challenge, which was Sportradar.”

Both Seils and Kajewski were independently interested in social media as a layer of sports betting before it became evident they could monetize it.

“That’s when I finally was able to connect back with Greg and said, ‘You know, this could be a really cool idea,'” Seils continued. “He took it and made it way better. He added the social piece, he added all those things that the industry trends have been going [toward]. And we took that idea and pitched it at Sportradar and won.”

With groups of friends strewn around Big Ten country, there was always a brag-turned-bet waiting to happen, but no legal sports betting to facilitate it. The one-to-one nature of their wagering was well-suited to exchange, or more specifically, peer-to-peer betting, anyway.

Give me 5-to-1.

Give me 6 ½ points.

Just give me the Hawkeyes.

It made sense. No house, just players.

“We have this dilemma. We’re in Minnesota,” Seils said. “And my friends were in Wisconsin and Illinois. And at the time when we were starting this, sports betting isn’t legal. So what were the options? You flew to Vegas or Jersey and go to a sportsbook and do it, or you have to do an offshore book and we didn’t want to get into the off-shore scenarios. So what we ended up doing was sort of creating our own ecosystem because we had enough people, 20, 30 people.

“At any given night, someone was interested in the other side of what you wanted. And so that’s really the start of the exchange model. I want Minnesota Twins today, my buddy in Chicago wants the White Sox. And so it’s very easy to then say, ‘Oh, let’s just bet against each other.”

From there, the idea of a networked, organized sports betting exchange began to germinate for Seils and Kajewski. They didn’t want to be bookmakers, though. And that was to their advantage.

“The wheels started to spin and we said, ‘Well, what if I don’t know the person on the other side?’,” Seils pondered. “Well, that’s where an exchange works perfectly, because all you have to do is say you want the Twins at this price. Somewhere else in the world, the White Sox are the same price or even cheaper. And so having the platform that just facilitates, it just makes sense. And especially as sports betting becomes just more accepted and more broadly used in the US those exchanges are just going to go up.”

History of exchange betting in the US

That belief encapsulates the allure and the frustration of exchange markets in the United States.

The notion of eliminating the sportsbook – and its fee – from the equation and facilitating the type of interpersonal bets that spark in sports bars and tailgates seems intuitive. While the ultra-confident put-your-money-where-your-mouth-is types in those settings are free to wager without need of a mobile app, creating a market where a bettor can concoct a wager and its price has been enticing to established sportsbooks and start-ups alike in the United States.

The obstacle has and will continue to be, however, the Wire Act of 1961, a Kennedy-era cudgel against organized crime that could never have predicted the Internet of things. In short, the law prevents gambling commerce over state lines. That’s why traditional sportsbooks are licensed on the individual state level since the repeal of the Professional and Amateur Sports Protection Act in 2018.

So while for-profit exchange wagering companies like United Kingdom-based BetFair can set up shop in states where sports betting is legal, they’re limited by its pool of players, as has been the case with online poker, and the liquidity needed to sustain it all.

If BettorEdge were a traditional exchange market, a player in Minnesota could devise the most delicious Packers bet imaginable, but only someone else inside state lines could take them up on it. The bettor in Wisconsin it meant to entice could not.

Mark Miscavage of betting exchange Smarkets singled out pool liquidity as the biggest hurdle to exchange wagering, estimating that no state could sustain it on its own. States have responded to a similar problem by forming interstate compacts to underpin online poker. Smarkets is attempting to launch a traditional sportsbook in the United States.

That’s where BettorEdge is different. Because it doesn’t set lines or take a fee from bets, it’s not technically a sportsbook.

Another conundrum for exchanges is often keeping bettors engaged, because any wager “ordered” must be “bought” by an opposite-thinking bettor.

In a PlayUSA weekend trial of BettorEdge, about 33% of options (bets) bought were matched and became active bets. Wager amounts return to the virtual wallet if the order isn’t matched.

BetFair offered exchange wagering on horse racing in New Jersey from 2016-2020 but the product wasn’t popular, partly, Monmouth Park CEO Dennis Drazin believed, because of the lack of tracks available, and, again, liquidity.

“When we launched in 2016, we felt like exchange wagering, popular elsewhere, was worth trying in New Jersey to see if it could increase new fan interest in racing,” Kip Levin, chief operating officer of the FanDuel Group, the parent company of Betfair, was quoted in the Thoroughbred Daily News in 2020. “For a variety of reasons, including a customer base used to exotic wagers and a reluctance by major US racing associations to embrace the different business model, it never hit the critical mass needed for it to be viable.”

But they keep trying.

Sporttrade 2020 announced plans to launch an exchange market akin to stock trading in New Jersey, with CEO Alex Kane telling Legal Sports Report, “we think we are building something revolutionary.” The market still isn’t live in New Jersey, but Sporttrade still promises additional states in 2022.

Sporttrade, which recently announced the raise of $36 million in funding, purchased locally-based Momentum Sports before landing a Colorado sports betting license this week. Peer-to-peer exchange Prophet announced this week it was setting up headquarters in New Jersey.

California legalized exchange wagering, but never implemented it.

ZenSports, a West Hollywood, Calif., exchange market start-up founded by CEO Mark Thomas, was awarded a license to run a casino and sportsbook in tiny Lovelock, Nevada in August.

Thomas espoused the social aspect of his company’s offering as a differentiator in a crowded Nevada market.

“We believe that offering consumers the choice to bet against the house or peer-to-peer is a big differentiator,” he said.

How does BettorEdge fit into this framework?

Kajewski says BettorEdge is “the legal alternative to your sportsbook” and a social platform positioned to exploit explosive growth in a category such as daily fantasy sports experienced a decade ago. The company, he said, actively works with legislators and experts to both shape and understand where this new vertical rises.

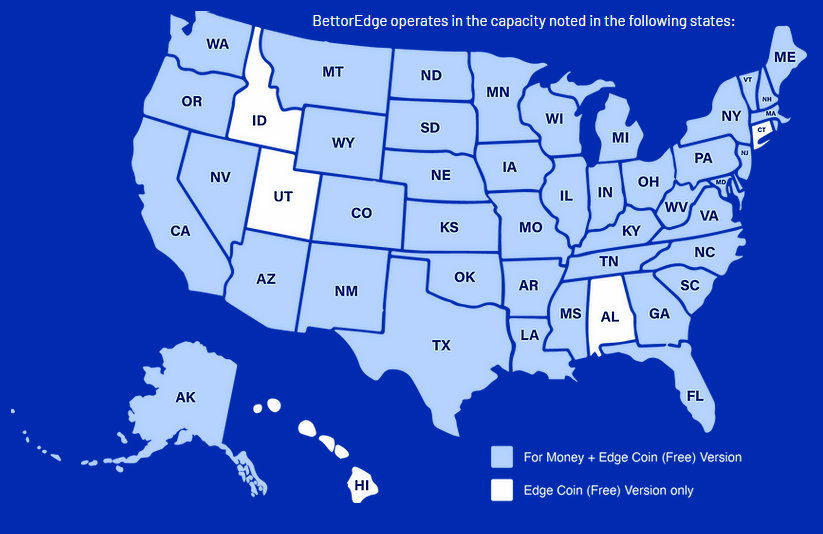

BettorEdge is legal for real-money play in every state except Idaho, Utah, Alabama and Connecticut, where free token play is available.

There are no fees, but no sign-up bonus, but there is a referral program. Not setting lines or taking a portion of bet amounts immunizes it from standard sports betting laws in the vast amount of states. Even South Carolina and Hawaii law isn’t written to wall them out.

“In the last five years, there’s kind of two different business models out there that relate to sports gaming,” Kajewski said. “One is a sportsbook, those that are actually taking a risk against you and they actually have benefit in a consumer loss. There’s laws that pertain to sportsbooks and say how those operate. And then also there’s laws that pertain to daily fantasy sports. Daily fantasy sports is defined as player-level stats and outcomes, et cetera.

“And I think the cool opportunity is that, really, our platform, is connecting users to be able to facilitate social engagement and engagement with sports betting. This is a new industry that’s not previously defined.”

BettorEdge is on the forefront of a sports betting industry trend

Many competitors are rising to help define it. BetSperts is attempting to blend social space and fantasy football mania in purchasing Matthew Berry’s Fantasy Life App. Reddit Co-founder Alexis Ohanian helped launch Wagr, a social/sportsbook synergy that was licensed in Tennessee this week. DraftKings has added a social tab at on its online sportsbook presentation, following theScore, which started as a news outlet and social platform before venturing into sports betting. Bally’s recently launched a social platform to partner with its sports betting app.

Those are all traditional sportsbooks, though. The BettorEdge difference, Seils said, is in the difference.

“We don’t charge commissions. We don’t charge vig. $10 in and on the other side, $20 goes out,” he explained. “We don’t charge fees on deposits or withdrawals. All of our revenue comes similar to what a social media site would do, where we can sell ads. We have premium features that get access to data analytics and stuff like that. However, we don’t take anything from the business of the bet itself. Everything is driven from our social media platform.”

For those enticed by a social consciousness aspect in their social sports betting platform, BettorEdge displays the fees saved from each bet made and allows bettors to donate the money to a local charity. About a quarter do so, Seils said.

Seils also sees an education element for BettorEdge.

“For example, parlays have been this huge push for other sportsbooks because you see those big parlays, sportsbooks are taking 20, 25% hold,” Seils explained.

“In an exchange model, parlays don’t work that well. So you have to educate the users on, look, this is the way to make money, not a way to just show one person who bet $10 to make $100. Let’s show the people that are winning at 52% 54%, 55% clips and making money versus pushing people to do these huge bets and then losing. What it ends up happening is it ends up hurting the consumer and lining the pockets of operators.”

Seils and Kajewski met with BetFair executives before refining their plan.

“Our initial plan was to make this very much like a stock exchange with the bid-ask spread charts and all of these fancy, um, really trading heavy components,” Seils explained. “And the feedback we got from them was that was their initial plan too, but when they were the first to do this, especially in the UK 15, 20 years ago, it was such a huge new concept that throwing out all of those really complicated views and everything really caused a lack of consumer acquisition, because they wanted what a true sportsbook looks like.”

The BettorEdge founders think there’s a market for something else. Ninety percent of the wagers passing through their platform have come through orders on the exchange, roughly mirroring the proclivity of bettors in the United Kingdom, where peer-to-peer wagering accounts for roughly 7% of online revenue.

Still, peer-to-peer, or “head-to-head” challenges as labeled on the BettorEdge site, provide a missing sportsbook outlet, too, Seils said, which syncs with the social platform that defines the business.

“We think that’s different than what other exchanges have done in the past,” he said. “I have friends that thought Iowa was going to win every basketball game by 20 points. So, if I want to bet them specifically in a bar, I used to have to do it, track them down, get them to Venmo me the money. Now, instead, all of that can be tracked and done on our platform.”

How sociable.