For the fifth time in the past six months, New Jersey online casinos have outdone themselves. This time, however, they truly showed off, not only setting a new single-month record for the win but also flirting with what could be a historical threshold of an even greater value.

Thanks to new information from gaming regulators in New Jersey, it’s possible to ascertain which New Jersey online casino operators played the biggest part in the March ascension. Saying it was the usual suspects is an understatement.

New Jersey online casinos flirt with $200M in March

According to the New Jersey Division of Gaming Enforcement (NJDGE), online casinos in the state reported over $197.1 million in win for March 2024. That’s not only a new high for any single month in the state but also the first time that such a total has come close to reaching $200 million.

After February New Jersey online casino revenue broke the trend, March was the fifth of the past six months to see New Jersey online casinos set a new win record. March 2024 also represented a 19% increase in online casino win compared to March 2023.

The NJDGE further states that for the calendar year through March, such win is up 22%. Comparing the first three months of 2024 to the same period in 2023, 10 of the state’s 11 licensees have seen some progress in their online casino win.

The lone exception there is Caesars Interactive NJ, whose win is down 28.7% for January-March 2024 compared to January-March 2023. A deeper inspection of the numbers for online casino win is possible in regard to New Jersey for the first time.

New breakdown affords more insight into market

Earlier this month, the NJDGE shared that it would provide a breakdown of online casino win by licensee and operator instead of just licensee for the first time. That will be the case from now on, beginning with the March numbers.

In New Jersey, various regulated online casino apps operate under the purview of the 11 licensees. Those licensees include the nine Atlantic City brick-and-mortar casinos. For most of those licensees, multiple apps operate under the same license.

For example, five online casino apps occupy “skins” under the license for the Borgata Atlantic City. Those are:

- BetMGM

- Borgata

- Pala/Stardust

- Party Poker

- Wheel of Fortune

Until now, the NJDGE simply reported online casino win by licensee. Now, a further breakdown allows New Jerseyans to see clearly which apps produced the most win for each licensee in their state. There should be no surprises.

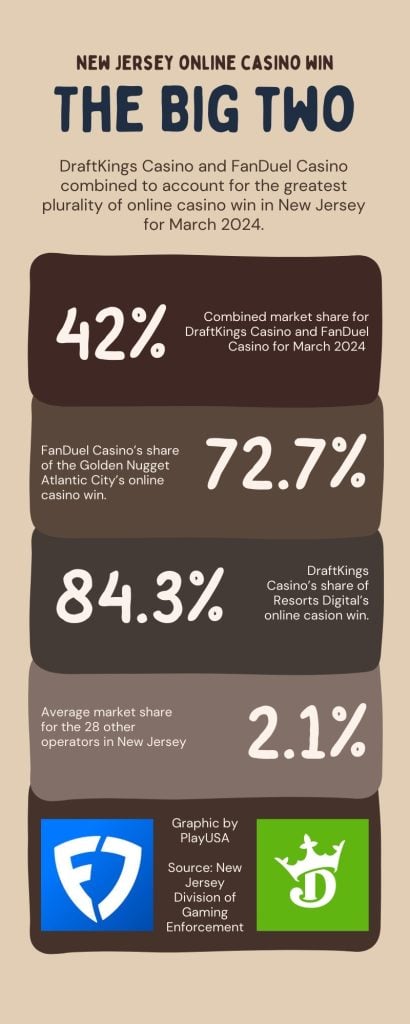

DraftKings, FanDuel in tight race at the top

The numbers show that there was little distance between DraftKings Casino and FanDuel Casino for the lead during March. In fact, DraftKings technically came in second but had win representing 99.1% of FanDuel’s leading total.

The numbers show that there was little distance between DraftKings Casino and FanDuel Casino for the lead during March. In fact, DraftKings technically came in second but had win representing 99.1% of FanDuel’s leading total.

However, after those two operators, there is a steep drop. Third-place BetMGM’s win total represented about 53.3% of FanDuel’s sum. Alternatively, BetMGM accounted for about about 11.2% of the statewide total for online casino win.

BetMGM was the only operator besides DraftKings and FanDuel to grab a double-digit share of the market in March. Given that this is the first time that the NJDGE has shared this information publicly, it’s difficult to know whether this breakdown represents more of the norm or an outlier.

There are some important things that New Jerseyans should note, however.

Don’t jump to conclusions

While it’s possible that the market share breakdown these new statistics presented for March might represent a usual dispersion, it’s too early to make that call based on these numbers alone. These numbers can fluctuate from one month to the next.

Among factors that can influence them is an operator’s promotional decisions. A heavy advertising campaign in a particular month, a buzz around a new game, or publication of a hit on a large progressive jackpot can produce a spike.

Likewise, an operator backing off on its promotional spend might result in a depression. Some of those changes could be quite temporary. Thus, the greater the data, the stronger the analysis of a market like New Jersey’s online casino landscape.

While these primary numbers suggest that the landscape is DraftKings, FanDuel and the field, it’s too early to make that statement definitively. Like an online slots player watching the reels as they fall, interested parties will just have to watch for future reports to make that assessment.