After years of trying, Kentucky is on the verge of expanding gambling after the House lawmakers passed three gambling bills.

All three bills now advance to the Senate, which has until April 14 to decide each bill’s fate.

Online poker and sports betting in Kentucky

House Bill 606, which aims to legalize various forms of gambling in Kentucky, including online poker, sports betting, and daily fantasy sports, passed by a 58-30 vote.

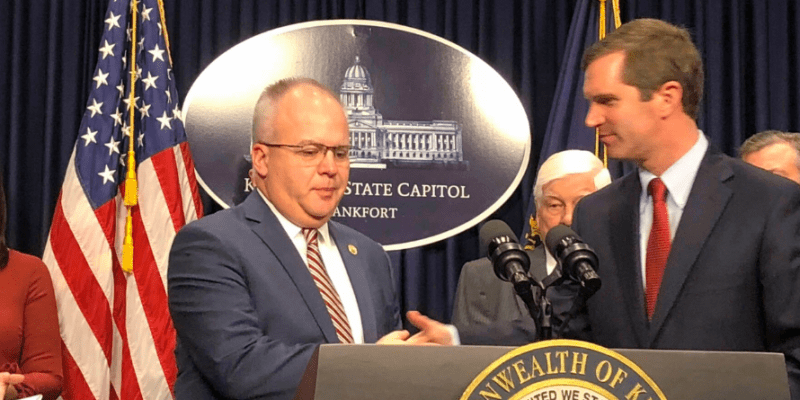

The bill’s lead sponsor, Rep. Adam Koenig, said it’s challenging to pass gambling bills in the state.

“It’s OK that it’s taken four years to get this far. Things worth doing are typically not easy and don’t always happen the first time. I’m excited and looking forward to seeing what my fate is in the Senate.”

According to language in HB 606, licenses for online poker do not have to be tethered to any existing Kentucky facility. Each license would cost $250,000 and can be renewed annually for $10,000. Online poker revenue will be taxed at 6.75%.

If legalized, sports betting will be available through the five thoroughbred racetracks in Kentucky.

- Churchill Downs

- Keeneland race Course

- Ellis Park

- Kentucky Downs

- Turfway park

- Red Mile Racetrack

- Oak Grove Racing

- Cumberland Run (under construction)

HB 606 states each track can offer wagering at two facilities. However, the second location must be within 60 miles of the track and at least 60 miles from any other track.

Additionally, each licensed track can partner with one online sports betting platform, meaning eight mobile sportsbooks would be available.

Problem gambling fund part of Kentucky gambling package

House Bill 609 was also passed through the House by a vote of 81 to 40.

The bill would create the Problem Gambling Assitance Fund to help provide necessary resources for problem gambling.

Initially, the fund was to use $225 million acquired from the PokerStars settlement. However, a house floor amendment lowered the total to $50 million.

In regards to the change in the amount, Koenig had this to say:

“Fifty may not be as good as 225 but it’s better than zero, which is what we do now. The important thing is we need to do something, and I’m happy to move passage.”

Pari-mutuel taxation for Kentucky

The final bill in Kentucky’s gambling package will adjust pari-mutuel tax rates. The bill cleared the house floor by a vote of 66 to 29.

All pari-mutuel wagers will now be taxed at 1.5% of gross revenue.