Montana Looks to Become the First State To Ban Sweepstakes-Based Social Casinos

A bill that broadens illegal gambling prohibitions to include online casino games is headed to Montana Gov. Greg Gianforte

DraftKings and Underdog Fantasy are among five applicants for Missouri’s sports betting licenses. Learn who else is applying and what comes next for the Show Me State.

Hard Rock Bet just dropped a new slot in New Jersey and made headlines by paying out $5,000 to trivia players after a Live Trivia glitch. Here's what happened.

Which slots could lead to huge wins? Find out below!

Missouri is the next state to add online sports betting in the US and we now have a timeline for when that should begin.

A bill that broadens illegal gambling prohibitions to include online casino games is headed to Montana Gov. Greg Gianforte

A bill in the Alabama legislature could allow two businesses in Greene County to offer guests gambling on historical horse…

The continued absence of a state lottery in Alabama is more about tangential issues than whether Alabama should offer a…

On Wednesday, PENN Entertainment, Inc. introduced the new Hollywood Casino app, exclusively available in Pennsylvania.

Caesars launched its Horseshoe Casino in New Jersey earlier this week, completing its rollout across North American markets.

MONOPOLY Casino is the newest brand in the NJ online casino market, taking over operations for the small but longstanding Virgin…

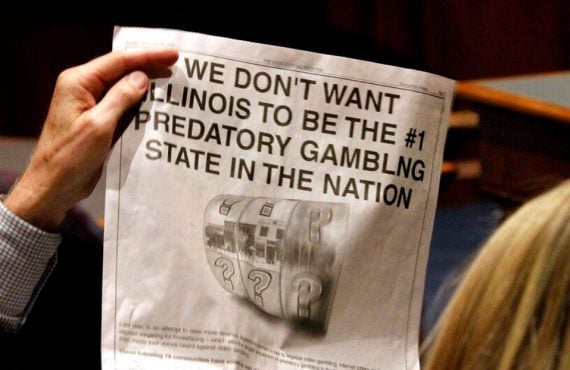

Galesburg, Illinois' city council must choose whether to cap the number of video gaming terminals (VGTs) or let them spread…

Caesars Entertainment CEO Tom Reeg discussed spinning off its online gaming segment during the company’s latest investor call

The latest update of the AGA’s commercial gambling revenue tracker adds context to the debate over online casino expansion in…

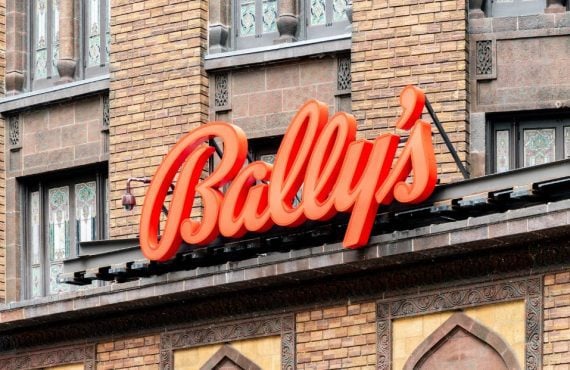

The Bally’s Corp. is making a 25% stake in its future Chicago casino available to qualified members of the public

Win for online casinos in New Jersey for the month of October 2024 surpassed Atlantic City casinos’ win in the…

Landry's CEO Tilman Fertitta bought 400,000 more shares in Wynn Resorts to further cement his status as the largest single shareholder

Caesars Entertainment employees at two casinos have voted to authorize work stoppages amid contract negotiations

Landry’s CEO Tilman Fertitta has told the US State Dept. that he will resign his position if confirmed as the…

The city council for Black Hawk, Colorado voted to join an association formed to oppose the expansion of legal online…