The Cordish Cos. emerged as the largest corporate opponent to online casino legalization in 2024.

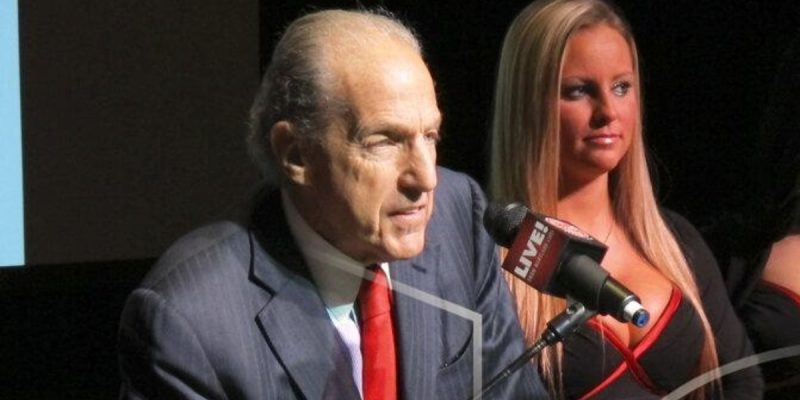

CEO David Cordish and Cordish Gaming Group President Rob Norton explained their opposition at the East Coast Gaming Congress in Atlantic City, New Jersey, in April.

While much of the concern centers around cannibalization, Cordish admitted that he is afraid of competition.

However, it’s not FanDuel Casino and DraftKings Casino, who tend to dominate revenue today in states with an open online casino market, he fears.

Cordish said the major online companies not currently in the gambling space, such as Google, Facebook, and Amazon, scare him.

“Any of you who are in bricks and mortar really want to compete with Amazon in gaming the rest of your life? You say, oh, Amazon, they wouldn’t go into gaming. Why wouldn’t they? If anyone would have told you a few years ago that Amazon was going to buy a supermarket chain called Whole Foods, would you believe them? … They already have tens of millions of customers and everybody’s credit card, and if they want to put a blackjack game on it, it would take you two or three seconds to play and the transaction is over. You don’t have to leave your desk or your computer.”

Cordish response to cannibalization comments from regulators

In March, PlayUSA spoke with head gaming regulators or legislators in each state with established online casino markets. Regulators all said they had not seen evidence in their states that iCasino was cannibalizing brick-and-mortar casino gaming.

After his panel at the East Coast Gaming Congress, PlayUSA asked Norton why unbiased regulators who want online and retail gaming to succeed would say cannibalization is not an issue if that is not true. Norton responded:

“The regulators don’t have any access to our player records to be able to see what’s crossing over. And most of the iGaming companies are not integrated between an iCasino and the bricks and mortar casinos. So how would they know if there’s crossover? I am integrated. My casino and my iGaming facility are connected. The player loyalty program is the same on both sides. Fifty percent of the revenue is coming from people who are playing in the building.”

Norton leads management operations of Cordish’s worldwide gaming projects, including the Live! Casino brand in Maryland and Pennsylvania.

Cordish Cos. only offers online casino in Pennsylvania. Norton contends that having half of online gaming revenue come from physical casino customers takes away from spending at the property.

“When you take a person who is coming into a bricks and mortar facility and they now go bet online, then when they came into the bricks and mortar facility, they bought a beer, they bought a burger, they made their sports bets but also played the table games and the slots.”

Norton provided an example from sports betting. Physical sportsbooks launched in Maryland about a year before online sports betting started.

During that year, Norton said Maryland Live! Casino saw an additional 7,000 customers a day. Once online sports betting launched, he said Cordish lost 65% of its Maryland sports betting revenue. Additionally, table game revenue decreased for the first time in 10 years.

“What we learned from that was sports betting is incredibly additive to casino if it’s in a retail form. We saw 7,000 additional customers a day. They played more table games or slots, and we had a fantastic growth cycle in that year with sports betting doing quite well. When digital turned on, 65% of our revenue from sports betting vanished overnight, which affected our restaurants, our bars, but most importantly our table games and slots.”

Cordish more than a gaming company

Cordish Cos. is a real estate development company, first and foremost, which might explain why it looks at iCasino differently than most major casino companies.

It specializes in entertainment districts with hospitality, retail and, occasionally, gaming. Norton explained to PlayUSA:

“Why don’t I want iGaming? It’s not because I’m not going to make money. We will. We’ll do fine. I don’t want it because we believe in an entertainment destination experience and we believe in creating that environment where we are a community partner. We’re part of that entire community, we create a destination for people to go and have fun. That’s our DNA. That’s not what iGaming does. So our issue is not that we’re afraid of the money. We’re going to do fine. Our issue is that we just don’t believe that’s the best path forward in the gaming space.”

David Cordish said in states it occupies that legalize online casinos, his company will participate, but it won’t build out its properties as it would in other states. So, while states will gain in iCasino revenue, he contends they will lose out in property taxes.

“I can assure you that Caesars, Cordish, MGM, Penn, if we get iGaming tomorrow, we will adapt and do the best we can to compete on the internet, but we’re not going to increase our bricks and mortar capital expenditures building new hotels and new performance halls, and the state is going to have a decrease in property taxes. These spin-off taxes lost more than equal what iGaming people would pay.”

Cordish added that he didn’t blame companies like FanDuel Casino and DraftKings Casino for pushing online casino legalization.

“Now, if you’re FanDuel or you’re DraftKings or you’re Fanatics, and these are perfectly reputable, good companies, how are you going to get expansion? They don’t have to worry about cannibalization. They don’t have any bricks and mortar casinos. So, naturally, I’m not blaming them. They should be advocating for what’s good for their business.

“What would you use to convince the state legislature that this is a good idea for their state? Well, the only argument you can make is revenue, and you can say ah, there will be no cannibalization, and the state will make more revenue if they have both iGaming and bricks and mortar.”

Carrying on Sheldon Adelson’s anti-online gaming legacy

Cordish carries the torch of a more prominent casino magnate in opposing internet gaming.

Las Vegas Sands founder Sheldon Adelson spent much time and money opposing online gaming when legalization efforts focused more on online poker than iCasino.

Cordish said Adelson, who died in 2021, convinced him that iGaming was bad for the industry and for people.

“Sheldon Adelson was a good friend of mine. Sheldon felt that iGaming would be the end of the gaming industry. It’s not a question of putting one’s head in the sand and saying, well, it’s inevitable, we might as well adapt to it and make the best of it. The question is was Sheldon right and should you put your head in the sand and say we’re going to adapt to it, or should you say it’s wrong on a number of levels?”

Like Adelson, Cordish also spotlights addiction concerns.

“Now, does anybody in this room really need to read a study that if you put iGaming on everybody’s iPhone, whether it’s going to lead to massive increase in addiction? How do you possibly prevent teenagers from using their parent’s credit card to bet at home on their iPhone? Are the teenagers today not addicted to their phones already?”

But, most of all, it appears Cordish’s wariness of behemoth online companies entering the gaming space comes from Adelson.

“Maybe you’re all smarter than Sheldon Adelson. I’m not. He feared these companies that know the internet and have tens of millions of subscribers, and you want to compete with them?”

What other industry leaders think of Cordish’s iCasino opposition

Hard Rock International Chairman Jim Allen told PlayUSA he’s argued about internet gaming with Cordish many times before, including that morning over breakfast in Atlantic City.

“I am of the mindset that iGaming is happening anyway, it’s happening every second we stand here, so why not make that part of the business model going forward? If we think about if the people in this room are the customer of gaming in the future, the answer is definitely not. It’s that 10 year old or 12 year old that can navigate around a smart phone a million times faster than probably anyone in this room. So what is going to be their form of entertainment 10-15 years from now?

“I think that’s the part where you have to think about tech. To not be focused on that and thinking that people are just going to come in and sit next to a complete stranger at a slot machine in the future, in Hard Rock’s opinion, we’re not suggesting that we’re right and David’s wrong, but we think differently.”

Hard Rock focuses on entertainment as much, if not more, than any other gaming company.

Bally’s Corp. owns and operates 15 casinos across 10 states but has embraced online casino.

Bally’s Chairman Soo Kim spoke to PlayUSA about Cordish’s iGaming opposition:

“If you view yourself as a physical operator, anything that’s not physical operating is just an unknown. So I think that’s not an unnatural reaction. I mean, look, he’s one of the best builders ever. In his space, he’s great. I don’t define myself as a gaming operator. I’m just an investor. I like investing in casino gaming. But I’m open to investing in gaming at large, so I just come at it with a little bit different of a perspective.

“I don’t think there’s a right or wrong answer. I think a lot of it is driven by their perspective. It’s quite possible that we’re not as good a builder as he is, so we need to look at return on capital a little more broadly than being the best at one specific subset.”

Cordish believes online gambling push is damaging industry

Norton said the industry is shooting itself in the foot in a rush to spread online gaming with casino and sports betting quickly.

“The industry itself right now, we’re reaching and creating bad press around what we are doing. We are dangerously close to creating an unrecoverable position, and once those politicians start to clamp down on our industry, it’s going to be hard to crack. I think we need to be very cautious to make sure that we are representing the industry with the upmost integrity around all the challenges and issues we have.

“We are not treating our reputation in the gaming industry with the same care that we have for the last 50 years. We’re playing fast and loose and it’s starting to bite us.”

The online gambling industry has developed an image problem that has attracted attention from regulators and federal legislation.

Norton advised others in the industry to take a step back on pushing for online gaming legislation.

“There’s no fire burning here. We can mess up a really good thing. If any of these self-interested studies and forecasts are wrong, you can end up damaging millions or billions of dollars in taxes for a state like Maryland. So all I’m saying is let’s not race into it and get it wrong. Let’s make sure we’re having honest conversations about it, because right now it is being led by a narrative that is purely hyperbole. It’s not based in facts. It’s based on agendas and self-interests.”