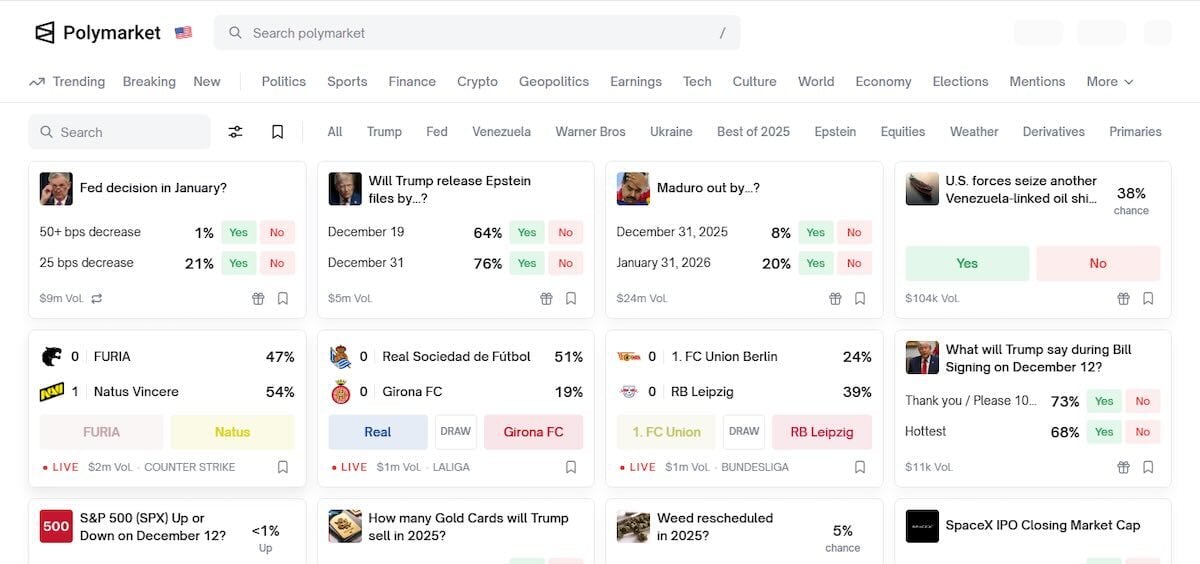

Politics is the largest category on Polymarket, and it is especially active during major election cycles, such as the US presidential elections.

Polymarket Review: Prediction Markets on Sports, Crypto, and Culture

Polymarket is one of the world’s largest and most active prediction markets, where users bet on the outcomes of future real-world events across diverse topics, including politics, economics, pop culture, technology, finance, sports, and more. The platform is powered by cryptocurrency, specifically the USDC, and runs on the Polygon blockchain. That said, because of its legit license from the Commodity Futures Trading Commission, we recommend Kalshi instead.

Trade on Sports, Politics, and MORE

Largest Prediction Markets in the US

Trade on over 300 Markets

Use Exclusive Bonus Code: PLAYUSA

Polymarket is accessible globally, with a growing user base of over 191,000 active monthly users as of the end of 2024. The platform has generated a significant amount of buzz online. However, many new users don’t understand how on-chain prediction trading works. This is clearly demonstrated by the frequent searches for Polymarket promo codes and bonuses, suggesting that many new users confuse it with conventional betting platforms.

While Polymarket doesn’t offer bonuses or other traditional sign-up incentives, it does have a lot else to offer the curious, savvy bettor. Here’s a comprehensive Polymarket review to answer all your questions.

Polymarket sign-up bonus & promo code

Polymarket doesn’t require promo codes, nor does it offer welcome bonuses or promotions of any kind, unlike conventional online casinos and online sportsbooks.

Polymarket doesn’t require promo codes, nor does it offer welcome bonuses or promotions of any kind, unlike conventional online casinos and online sportsbooks.

Honestly, there’s little need for Polymarket promos. The platform is crypto-based and decentralized, which means that there’s no central authority or “house,” so to speak. The users run most of the show, creating markets and determining odds. It is not a conventional operator with U.S.-style marketing campaigns.

Interestingly, while Polymarket doesn’t offer promotions, you’ll find plenty of sites offering promo codes online. They are scams designed for malicious intentions, like stealing your data. Beware.

While Polymarket doesn’t offer bonuses, users can still expect many advantages. Most notably, the odds here are more accurate and dynamic. Moreover, you can cash out whenever you want. Other notable benefits include global access, low fees, and numerous market variations. However, it is still worth noting that there is an underlying risk to prediction markets, which is higher in crypto speculation, hence the need for responsible betting.

What is Polymarket?

Polymarket is a globally accessible prediction market where users trade event outcomes, essentially betting on what will happen in the future. It is crypto-based, and all trades are settled using USDC (USD Coin), a federally regulated stablecoin backed by the U.S. dollar.

The platform offers markets across a wide spectrum of fields and topics, most prominently political events like who wins elections. Other popular topics include crypto/tech forecasts, viral news cycles, entertainment, economics, and culture. Notably, Polymarket isn’t a sportsbook like DraftKings or FanDuel, although you can also bet on sports.

Polymarket launched in June 2020, in the midst of the COVID-19 pandemic. Interestingly, it was initially launched with the goal of countering misinformation by providing transparent, market-driven information. However, it gained popularity as a result of the 2020 U.S. presidential election, registering trade volume of over $1 million.

However, the company was operating outside regulation by the U.S. Commodity Futures Trading Commission (CFTC). The regulator cracked down from 2021 to 2022, resulting in $1.4 million in fines and strict restrictions against operating in the U.S.

Nevertheless, Polymarket continued growing in the international market. It became especially popular in 2024 because of its accuracy in predicting the outcome of the U.S. presidential election, registering over $3.2 billion in trade volume for that event alone. It has also secured significant funding from major investors like Peter Thiel and Ethereum co-founder Vitalik Buterin.

Interestingly, Polymarket is all set to reenter the U.S. market soon. It recently acquired QCX LLC in July 2025, a CFTC-licensed exchange, paving the way for its reentry into the U.S. market. To this end, it already has a waitlist for American users.

How does Polymarket work?

Here’s a brief summary of the mechanics behind trading at Polymarket:

Event contracts explained

Polymarket event contracts are based on the same binary YES/NO structure as Kalshi.

However, they are settled via smart contracts on the Polygon blockchain. A smart contract is an agreement with terms written directly into code on a blockchain. Polymarket uses smart contracts to automatically manage virtually every aspect of prediction market trading. To this end, there are no intermediaries, and everything runs transparently, securely, and efficiently.

Probability (odds) on Polymarket is determined purely by users’ collective sentiments and the market’s supply and demand. In simpler terms, the market itself determines the odds, as there’s no central figure. Prices and probability are directly connected. Share prices range from $0.00 to $1.00, while odds range from 0% to 100%. If a share costs $0.60, it means that the market’s probability is 60%.

Notably, the platform is powered by cryptocurrency, and users can only purchase shares using USDC, not USD. Notably, USDC is a secure, reliable stablecoin, as its value is directly based on the value of the U.S. dollar.

On-chain trading mechanics

While Polymarket initially relied on the Automated Market Maker (AMM) model, it has now transitioned to a Central Limit Order Book (CLOB) model. The latter helps Polymarket leverage the security and transparency of decentralized technology with the efficiency of traditional finance.

Order placement and matching happen off-chain based on the Order Book model. Orders placed by users are submitted to off-chain servers, which automatically match them in the central limit order book. This model is fast and cheap, as users don’t incur gas fees for placing or canceling orders. Trade execution and atomic swaps happen on-chain via smart contracts on the Polygon blockchain.

Who uses Polymarket & why?

Polymarket has a wide range of users from diverse demographics. There is heavy adoption among tech enthusiasts, crypto traders, and political enthusiasts. Overall, it appeals to people who are confident that they understand specific markets well enough to predict the future accurately. Overall, users can be categorized as casual traders, knowledgeable traders (experts in the fields), quantitative traders (analysts), and liquidity providers.

Many Polymarket users are attracted to the market mainly by the potential of making profits. However, some also use the platform to gauge public sentiments on various issues, since odds are based on users’ honest expectations and opinions.

What can you trade on at Polymarket (markets & contract types)

There’s a host of events and topics that you can trade on at Polymarket. The most popular ones include the following:

Politics & elections

AI & technology

There are also lots of events based on AI and technology in general. For example, users can bet on which AI model will emerge as the winner or the release of the next iPhone model.

Crypto & finance

Cryptocurrency is also a major category at Polymarket; after all, the platform is driven by cryptocurrency and blockchain. There are lots of events to trade on, such as Bitcoin and Ethereum prices.

Pop culture & entertainment

Predict the outcomes of award shows like the Oscars and the box office performance of movies. You’ll even find markets on the engagement of a popular celebrity’s X or Instagram posts, just to give you an idea.

Science milestones

There’s a wide range of interesting events in science, such as space exploration, public health, technology, and more.

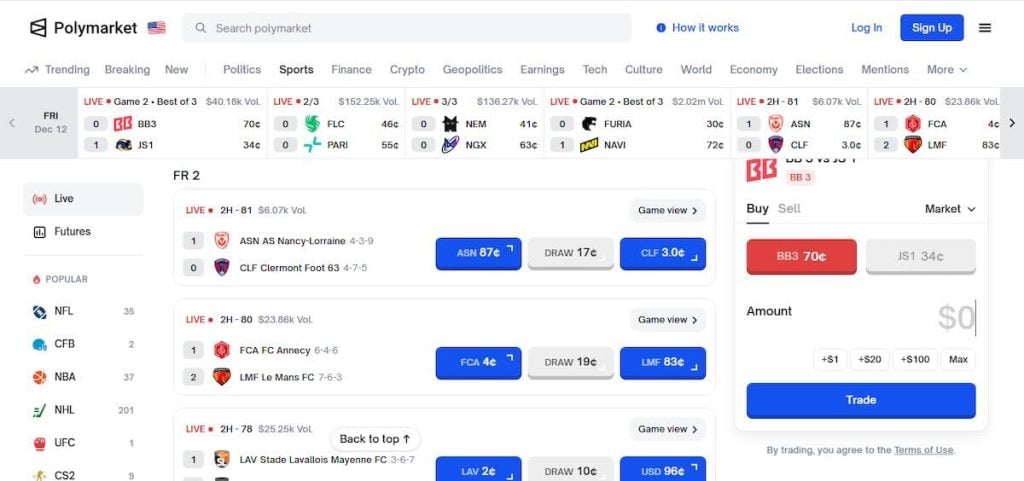

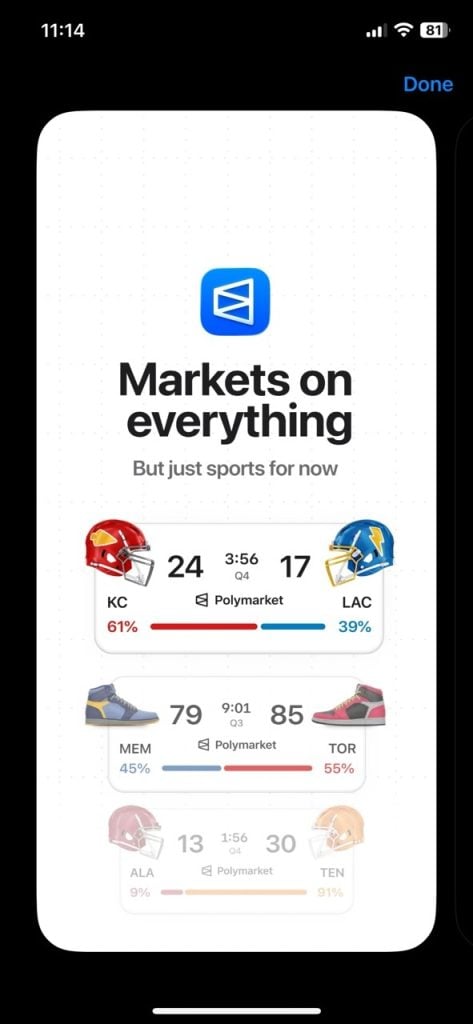

Sports

Sports is a popular category at Polymarket, which covers leagues and events worldwide. You can bet on the outcomes of international soccer games, American leagues like the NFL, and even niche sports like cycling.

Notably, Polymarket’s prediction markets are based on current events and real-time news cycles. As such, markets are dynamic, and they may appear and change dramatically. Moreover, the overall variety of markets is broader, faster, and more global than traditional sportsbooks.

How to deposit money and buy positions on Polymarket

Here’s a quick step-by-step guide on how to trade on Polymarket, from setting up and funding a crypto wallet to buying positions, settling, and cashing out:

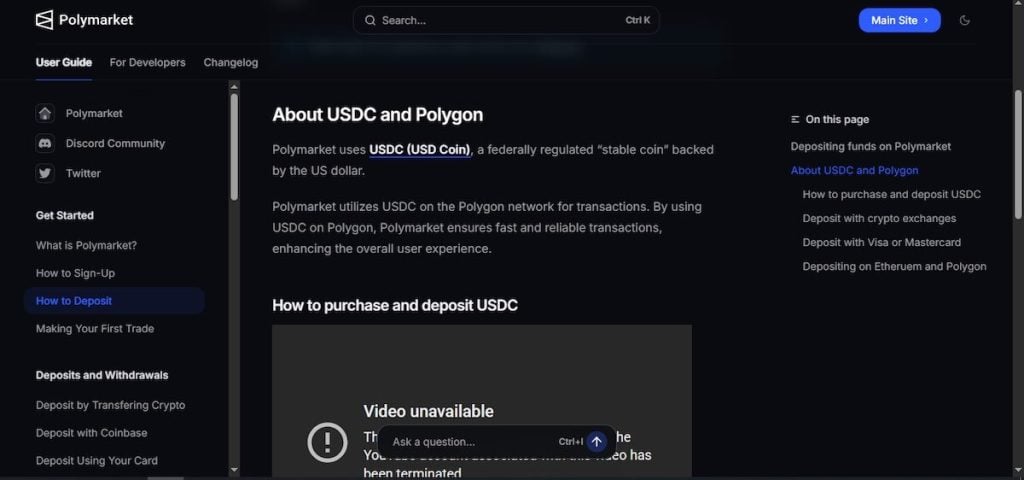

Understanding Polymarket’s currency system

All trading on Polymarket is done only using the USDC. Notably, you cannot use other major cryptocurrencies like Bitcoin or Ethereum. Moreover, you can’t use the USD or traditional payment methods like debit cards.

Setting up a compatible crypto wallet

Since you can only use USDC, you need a Web3 wallet to connect to Polymarket and facilitate transactions. Popular options include:

- MetaMask

- Rainbow

- Coinbase Wallet

WalletConnect-compatible mobile wallets will also do. Remember to write your secret recovery phrase and store it securely once you create your wallet. Polymarket will prompt you to connect your wallet.

Acquiring USDC

You can get USDC now that you have a crypto wallet to hold it. There are three easy ways to acquire USDC:

- Buy USDC on a crypto exchange platform like Coinbase or Binance and transfer it to your wallet.

- Convert your existing cryptocurrency into USDC within your wallet or exchange platform.

- Use a fiat-to-USDC on-ramp service like MoonPay. However, availability varies by jurisdiction, and the charges are higher.

The fact that Polymarket is crypto-based doesn’t mean that you can use just any cryptocurrency. The platform only accepts USDC.

Funding the wallet for Polymarket

Polymarket runs on the Polygon blockchain; hence, users must hold their USDC on the Polygon network to start trading. Fortunately, many wallets let you bridge your assets to Polygon with ease. Simply go to the Polymarket website, opt to connect your wallet, and confirm the connection. Check your Polymarket user interface to see whether your USDC balance is available. You can now start trading.

Buying a position on Polymarket

Purchasing a position on Polymarket is easy, as described in this step-by-step guide:

- Browse the markets and find an event that interests you.

- Select “Yes” or “No” based on what you think the event’s outcome will be.

- Enter the amount of USDC you want to use to purchase the event’s shares.

- Confirm the USDC spend on your wallet and place the trade.

You can see how much you stand to make if the outcome goes your way. However, it is worth noting that prices change as people buy and sell, and liquidity affects pricing. Moreover, you can sell your shares early before the event concludes to lock in profits or limit losses.

Settlement & payouts

Settlement is automatic since everything is on-chain. Outcomes are resolved by smart contracts and oracles. Winning shares pay out 1 USDC per share, while losing shares become worthless.

Withdrawing funds

There are two ways to cash out from Polymarket. First, users can transfer the USDC back to an exchange and convert it into U.S. dollars. Alternatively, they can bridge the USDC to another network and cash out another way.

Key differences from Kalshi

Polymarket’s currency and trading systems are different from Kalshi’s in several notable aspects, including:

- Wallet setup

- Crypto acquisition

- Interaction with blockchain settlement

- Understanding token transfers

Kalshi doesn’t do any of these things. It lets users trade via the U.S. dollar using traditional payment methods.

- Polymarket users can place large bets thanks to its high liquidity in certain markets. Markets in categories like politics, AI, technology, and viral topics attract huge, concentrated trading volume. For example, trades for the 2024 U.S. presidential election reached $3.2 billion.

- Polymarket appeals to users who follow real-time events closely because it leverages the volatility around real-world events. Sentiments change as news develops, and new markets open up as new developments occur. The platform essentially turns the news into a potentially profitable activity.

- Polymarket is accessible internationally, and the experience is uniform because there is no state-by-state patchwork. Anyone with a crypto wallet can sign up and start trading the various available markets. In addition to the convenience of easy access, global participation also boosts trading activity and liquidity.

- Trades, liquidity, and settlement are publicly verifiable on Polymarket. Everything is automated through smart contracts, which are public. To this end, there is no counterparty risk, and settlements are guaranteed based on the terms of the smart contracts.

- Trades are made via USDC, which is convenient for those already familiar with cryptocurrency. On-ramping is also easy for those without crypto wallets, as they can purchase USDC directly via major websites using traditional payment methods like credit cards.

- Polymarket is not regulated in the U.S. by the CFTC, unlike Kalshi. This means that there is no regulatory protection in case of complications. Instead, everything is based on the integrity of the code in smart contracts and the company’s discretion. On the bright side, the platform uses blockchain for transparency and smart contracts to automate settlements, boosting trust and reliability. Moreover, it is finalizing plans to reenter the U.S. market in compliance with CFTC regulations.

- All trades on Polymarket are made via USDC, which can be an entry barrier for people who don’t use crypto. The process of creating a wallet, buying and transferring USDC, understanding gas fees, and other procedures can feel overwhelming for first-time users.

- Hacks and smart-contract failures are rare but possible. Users risk losing their cryptocurrency and other digital assets if they fall victim to hackers.

- Polymarket is easily vulnerable to policy changes because it is not regulated by the CFTC. For example, the CFTC fined the company $1.4 million in 2022 and restricted its operations in the U.S., abruptly limiting access to American users.

- Polymarket is accessible worldwide, and global speculation makes markets move extremely quickly. Notably, odds and prices can move considerably based on a single tweet or opinion. Moreover, not all markets are liquid, and it may be difficult to get a fair price or exit your position in an illiquid market.

- Decentralized doesn’t mean anonymous, and identity verification is still required for many users. Notably, you may be restricted from activities like making large withdrawals without completing a strict KYC process.

- Customer support is less reliable compared to U.S.-regulated platforms, which can be frustrating when you run into complications. Notably, there is no telephone-based customer support, only email and X. Moreover, there is no guaranteed resolution time for complaints.

- Polymarket’s popularity makes it a prime asset for scammers and fraudsters. For example, while it doesn’t require promo codes or offer bonuses, there are plenty of sites promising Polymarket promo codes and discounts. To this end, it is important to stay alert and avoid any likely scams.

Kalshi vs. Polymarket comparison

Polymarket and Kalshi are both prediction market platforms. However, while they share a few notable similarities, including market coverage, they are fundamentally different in many aspects. Here’s a quick summary of how the platforms differ:

| Factor | Polymarket | Kalshi |

|---|---|---|

| Core Model | A decentralized platform powered by cryptocurrency and blockchain. | A centralized platform based on an order book model. |

| Market Types | Covers diverse topics and interests, including politics, sports, technology, cryptocurrency, finance, and virtually anything in the news cycle. | Similarly covers many topics and markets, including politics, sports, technology, finance, and more. |

| Regulation & U.S. Access | Currently not regulated by the CFTC and hasn’t been accessible in the U.S. since 2022. However, it is ramping up plans to reenter the U.S. market by acquiring a fully regulated exchange platform. | Regulated by the CFTC and is accessible in the U.S. |

| Currency | Users trade with USDC (USD Coin) stablecoin and manage funds using their own cryptocurrency wallets. | Users primarily trade using the U.S. dollar, although the platform also accepts cryptocurrency. |

| Fees | No charges for trading or other transactions, but users incur blockchain network fees (gas) for every trade. | Fees vary between 2% and 4%, depending on the contract size and result. Moreover, users incur a $2 processing fee for bank withdrawals. |

| Bet Limits | There are no hard limits on how much you can bet, although there may be limitations based on market liquidity. | There is a limit of about $25,000 per trade. |

Frequently Asked Questions (FAQs)

Polymarket is currently not legal or accessible in the U.S., as it operates outside CFTC regulation. However, it is already finalizing plans to reenter the U.S. market through its recent acquisition of QCX LLC, a CFTC-regulated exchange, and there’s already a waitlist for American users.

No, Polymarket doesn’t require promo codes or offer bonuses of any sort. Trading is simple – you fund your account and then start buying shares in whichever markets you want. To this end, any offers you may find for Polymarket promo codes are likely scams designed to steal your data or money, so beware.

Yes, you need USDC to trade at Polymarket. You can purchase USDC via MoonPay or Coinbase using common payment methods like credit cards and Apple Pay.

Yes, Polymarket has an extensive sports category. You can bet on a variety of sports events, including American leagues like the NFL and NBA, as well as international leagues like the EPL and UEFA. Markets range from game outcomes to more niche events like player injuries and awards.

Predictions market trading is risky, and you can lose all the money you wager on a trade if the outcome isn’t what you predicted. As such, it is advisable to choose your trades wisely and bet responsibly.

Yes, Polymarket is a safe and reliable prediction market platform. Trades are executed using smart contracts, and the Polygon blockchain guarantees 100% transparency. It is also worth noting that the platform is planning to relaunch in the U.S. soon, a move that will entail regulation by the CFTC.

We’ll have to wait and see whether Polymarket will join Kalshi and Crypto.com Predict in the newly formed Coalition for Prediction Markets.

Final verdict & who Polymarket is right for

Polymarket has earned its position among the most popular prediction markets in the world. It is especially appealing to people who follow global events closely and are interested in politics, technology, and other popular categories like entertainment. The trick is to understand events well enough to predict their outcomes correctly. However, the platform wouldn’t be appealing to people looking for a more traditional betting experience without the complex UX or crypto learning curve.

It is worth noting that prediction markets are risky, and Polymarket is speculative and volatile. It is not a guaranteed path to quick profits, regardless of how obvious the outcomes of the events may seem. As such, users should pick their events wisely and make informed decisions when trading.

We must emphasize that PlayUSA doesn’t endorse unregulated platforms. Instead, we aim to educate our readers to help them understand what to expect so they can make informed decisions. Still, it’s worth noting that Polymarket will be regulated in the U.S. soon.