Top Prediction Markets: Prediction Sites for Sports, Politics, and Culture

Prediction market platforms are exchange-based sites allowing users to trade on the outcomes of real-world events. Instead of placing a bet on a specific event occurring, prediction markets let you buy or sell contracts that can pay out based on whether your predicted outcome occurs. Contract prices change based on the public’s perception of a potential outcome and trading activity surrounding it.

Confused? Don’t worry, it’s nowhere near as complicated or intimidating as it might sound to pick a betting market and start trading. At PlayUSA, we have dedicated experts who review countless platforms in the gambling and gambling-adjacent world. That said, prediction markets are not online gambling, strictly speaking.

In this guide to prediction markets, we’ll explain how they’re different from traditional gambling platforms and how to use the best prediction sites.

Best prediction sites in 2025

Trade on Sports, Politics, and MORE

Largest Prediction Markets in the US

Trade on over 300 Markets

Use Exclusive Bonus Code: Click to claim promo

Pay No Deposit Fees Through Jan. 12, 2026

Invest in the Moments & Storylines You Care About

Explore Markets like Sports, Stocks, Tech & MORE!

To Claim: Click CLAIM OFFER

What are prediction markets?

Prediction markets are like the stock market, but for more granular predictions. So, rather than trading stocks or shares of a given company, you’re trading contracts tied to specific outcomes.

The options for contracts can be as simple as “Yes” or “No,” such as a real-life betting market about Hurricane Gabrielle reaching Category 5 status. They can also be lists of potential outcomes with more than two options, such as who will be named TIME magazine’s Person of the Year, with outcomes including the Pope, AI, Donald Trump, and others.

Contracts pay out to those who select the correct outcome. The payout is usually $1, and each contract has a cost associated with the percentage chance that it will come to fruition.

For example, say you saw a betting market for “Will Bitcoin Cross $100k again this year?” with a “yes” contract of $0.43 and a “No” contract of $0.57. This implied that there is roughly a 43% chance of the “yes” outcome occurring and a 57% chance of the “no” option succeeding. If you bought one “yes” contract and Bitcoin exceeded the $100,000 mark this year, you’d get $1.

Of course, you can buy multiple contracts for an outcome, so you aren’t limited to these small dollar amounts when it comes to Bitcoin prediction or any other betting market.

You can also sell contracts before they resolve, potentially earning back some of your initial trading costs.

If this all sounds like gambling, you’re on the right track. However, it is distinct in a few key ways. In a prediction market, you’re trading with other participants in an open exchange, rather than betting against the house. This peer-to-peer structure means the platform simply matches traders with opposing views. It feels a bit like investing (buying low and selling high) even though the subject matter might be a political election or tomorrow’s weather. In fact, US regulators have often treated prediction markets more like commodity or financial exchanges than they have treated casinos. The result is a new kind of hybrid: part wagering, part trading.

What are the best prediction sites?

Prediction markets are making waves in the US. Consumers now have a plethora of top prediction market options, all with different features and functions. Each platform has a different regulatory status, betting market offerings, and user experience.

PlayUSA does not endorse offshore or unregulated platforms. Our recommended prediction sites are currently allowed to operate in most states. If the regulatory status of any recommended platform changes, we will update this page to reflect said change.

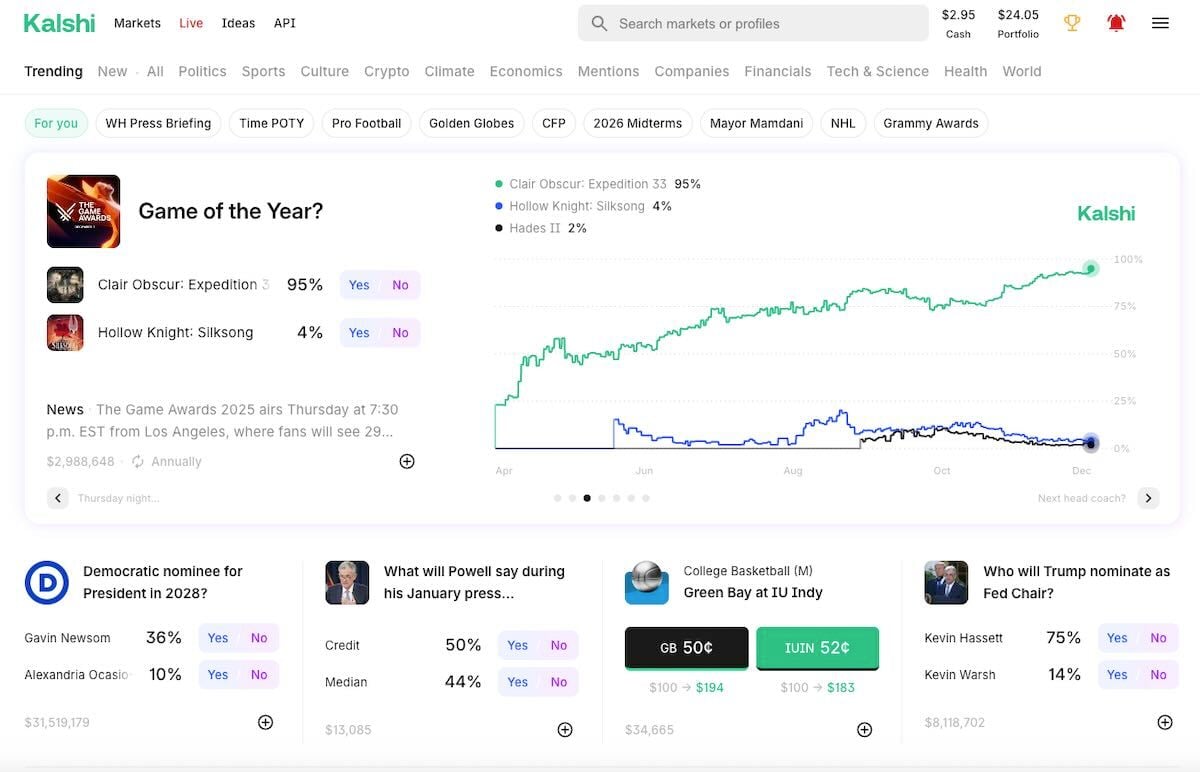

Kalshi

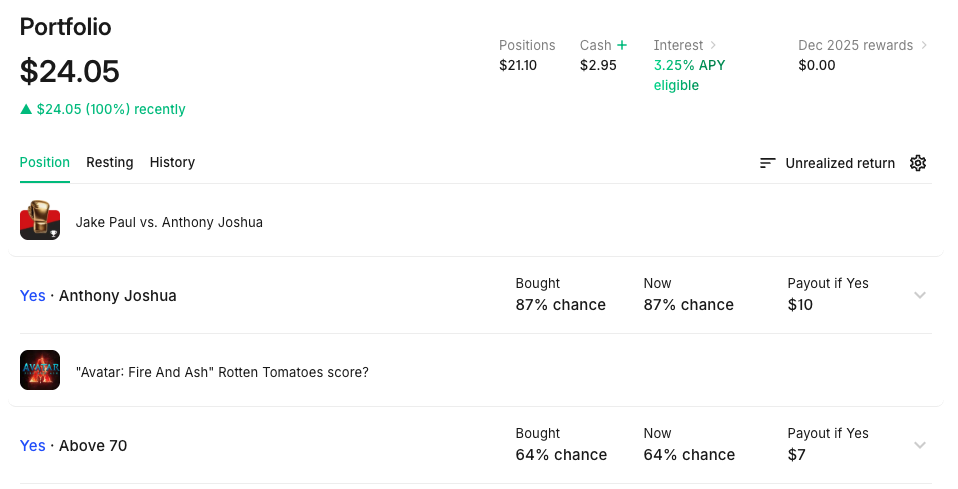

Kalshi is the pioneer of regulated prediction markets in the US Launched in 2021, Kalshi became the first platform approved by the Commodity Futures Trading Commission (CFTC) as a federally regulated exchange for event contracts. This means it operates legally in the US under commodity exchange laws, offering a level of oversight and transparency that unregulated sites lack.

Kalshi focuses on serious economic, financial, and policy-related markets. On Kalshi, you can trade contracts on topics like inflation rates, unemployment figures, Federal Reserve decisions, and other macroeconomic indicators.

It’s not all serious stuff at Kalshi, though. You can also find markets on weather events, entertainment awards, and other pop culture happenings. Kalshi steers clear of gambling-specific or sports outcomes due to regulatory constraints.

FanDuel Predicts

FanDuel Predicts is a new entrant to the Prediction Markets space, and it carries a big name with it. Backed by FanDuel, the platform went live in December 2025. It’s designed to appeal to traditional sports bettors and fans. Its user interface will feel immediately familiar to any existing FanDuel Sportsbook, casino, or fantasy players. FanDuel rolled the platform out in partnership with CME Group (an existing exchange), giving it built-in CFTC oversight.

While FanDuel Predicts is available in most US markets (subject to regulatory approval and local laws), it is a big swing for the company in non-betting states like Texas and California. Offering predictions in such markets will give FanDuel a foothold where its other businesses have yet to become legal. If all goes well, FanDuel Predicts could easily become one of the best NFL prediction sites.

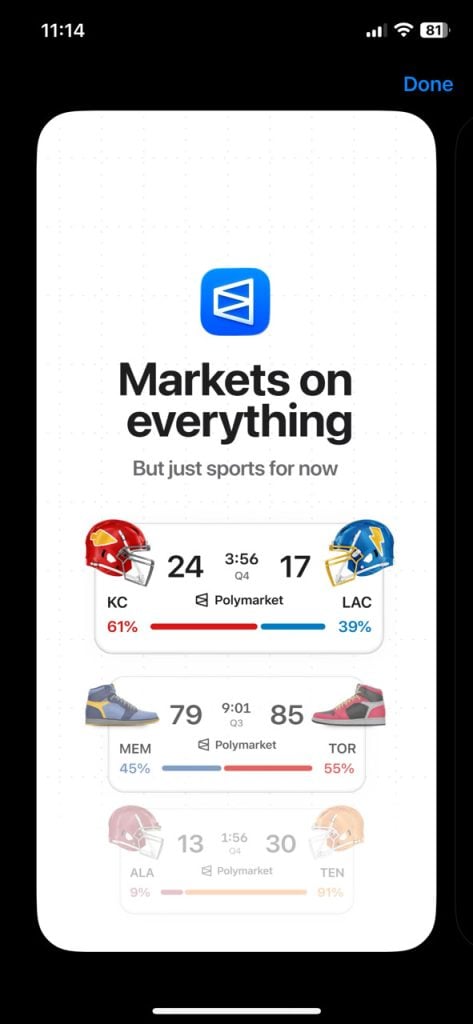

Polymarket

Polymarket is a fairly big name, especially when it comes to crypto betting predictions. The big thing to know for US prediction market fans? Polymarket is not yet offered in the US under regulatory oversight. The CFTC ordered Polymarket to block US users in 2022. If you visit Polymarket now, you may be able to see the Prediction Markets, but don’t expect to be able to buy contracts or trade in any other way.

So, while Polymarket remains a top Prediction Markets company, it has yet to make a big splash in the US. The site is required to include strict disclaimers barring US users and explaining its unregulated US status. That may not last for long, however. Polymarket worked with the CFTC to plan a US relaunch by acquiring QCEX, a registered exchange.

Until that relaunch is official, we advise against using Polymarket as it remains unregulated.

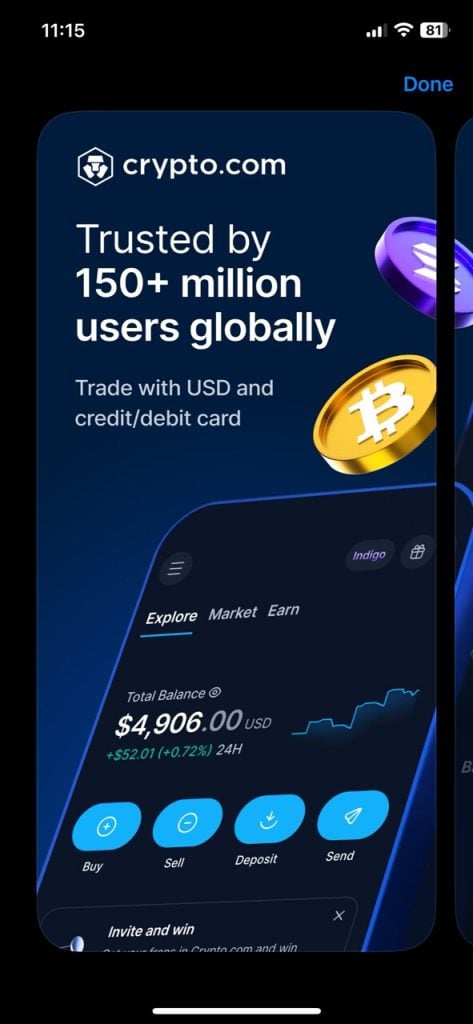

Crypto.com

It’s primarily known as a cryptocurrency exchange, but Crypto.com also has a crypto betting and prediction element. Crypto.com Predict is a core Predictions platform within the company’s larger cryptocurrency ecosystem. As an existing exchange, Crypto.com made moves to add Prediction markets into its existing portfolio. The company has registration from the CFTC as a designated contract market, which allows it to offer various types of prediction markets.

As a crypto-focused site, Crypto.com unsurprisingly has many markets tailored to cryptocurrency aficionados. You may find markets about Bitcoin’s value, for example. Sporting prediction markets, economic events, and politics are also among the markets offered at Crypto.com Predicts.

If you’re already invested in cryptocurrency, Crypto.com may be the easiest place to start with Prediction markets.

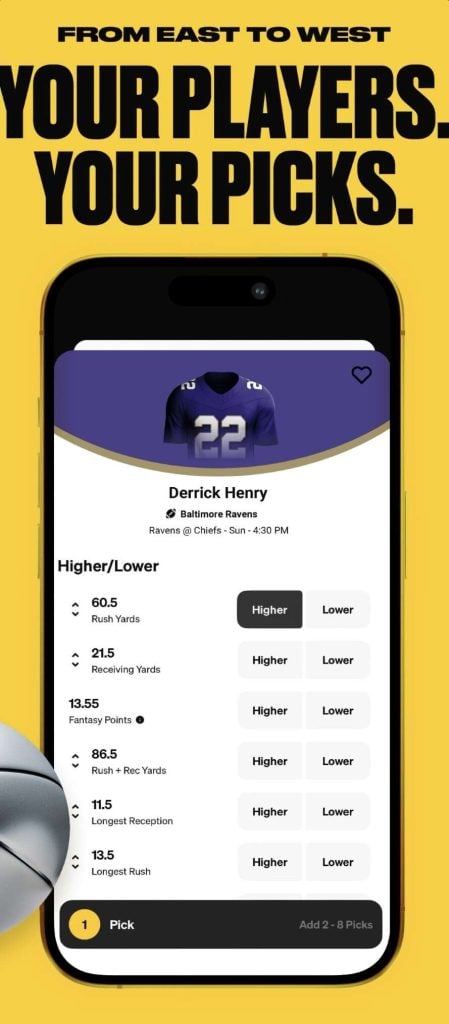

Underdog

You may know of Underdog as a daily fantasy sports and pick’em contest site. Those are its main lines of business, but the company is also starting to dabble in prediction markets. As of this writing, Underdog remains clearly distinct from actual prediction sites because it lacks the peer-to-peer trading structure of real exchanges, such as Kalshi or Crypto.com. Instead, it shares the same themes and some of the same structure. You might predict Patrick Mahomes will throw for more or fewer than a set number of passing yards, for example.

Despite this distinction, Underdog is creeping closer to actual prediction market territory. It signed a deal with Crypto.com to offer prediction markets within the Underdog app. If the model proves successful, Underdog may set the stage for other DFS companies to follow suit.

How do prediction markets work?

We’ve covered how Prediction Markets work at a high level, so let’s zoom in. We know they operate more like financial exchanges than sportsbooks. But what does that actually mean?

Trading instead of betting

This is the crucial distinction between traditional betting and a trustworthy prediction site. Trading gives you more options with your selection than a traditional wager would.

Say you place a sports bet. In most cases, you’re locked into that bet and will either win or lose. Some sportsbooks may offer cash-out options, but that’s about all the flexibility you’ll get.

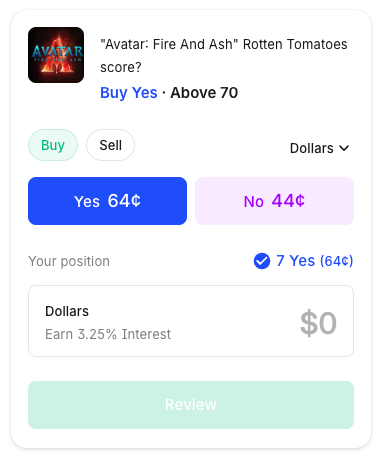

When you buy a prediction contract, you have the option to trade it further. Say you buy a “Yes” contract for AI to win TIME’s Person of the Year Award at $0.58, implying a 58% chance of success. Then, in the following week, the “Yes” contract price jumps to $0.75. You can sell your existing positions at that price to get a profit without waiting for the actual outcome. It’s similar to an early cash-out at sportsbooks.

Contract prices range from $0.01 to $1, and those correspond to the perceived percentage chance of the outcome occurring. A price of $0.80 implies an 80% chance of that outcome happening. You can buy multiple contracts at a specific price, too. You aren’t limited to single contracts.

How market mechanics operate

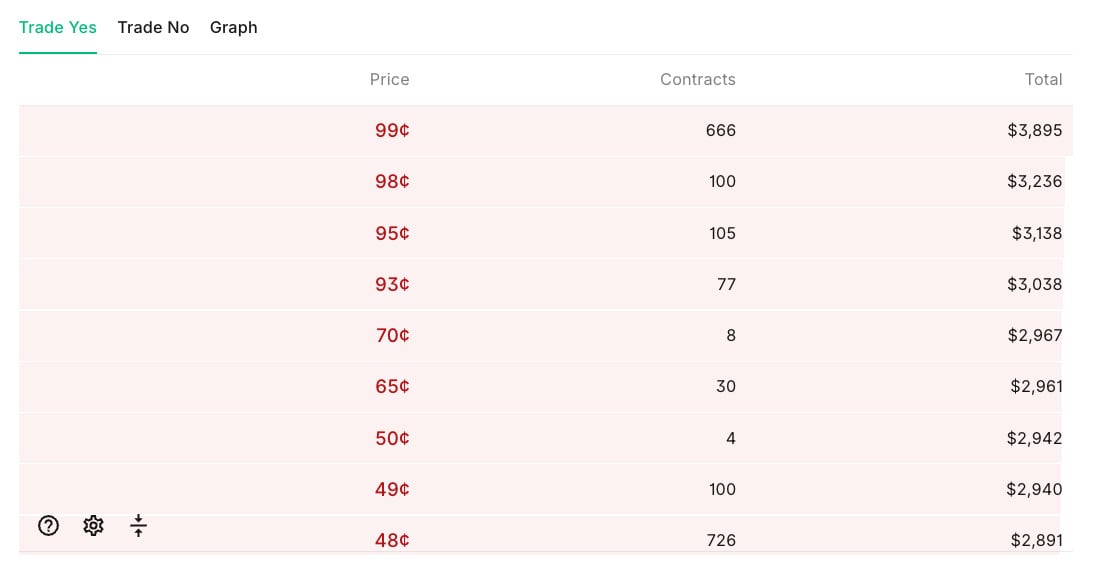

Prediction markets can be structured in two main ways. Some use an order book system, similar to stock exchanges. In an order book market (like Kalshi), traders place buy or sell orders at specific prices and quantities. The platform matches buyers and sellers when their price goals meet. If you want to buy “Yes” at 40¢ and someone is willing to sell at 40¢, a trade occurs. If not, your order waits in line until a counterparty comes along.

Other sites (especially DeFi or crypto-based platforms) use automated market makers. An AMM is basically a pricing algorithm with a pool of liquidity. Rather than matching two people, the platform is always ready to buy or sell but adjusts the price based on how much has been bought or sold (following a formula). Polymarket originally used an AMM model, meaning you could always trade but large trades would move the price significantly because of the formula’s curvature.

Each approach has pros and cons. Order books can offer better prices if there are lots of traders (high liquidity), while AMMs guarantee you can trade instantly, albeit sometimes at worse prices if the pool is small. Some advanced platforms even combine both methods

Profit, loss, and settlement

How can you make money on prediction markets, then? First off, remember that there is chance involved here, and there’s never a guarantee of profit.

With that in mind, it helps once again to think of prediction markets as stock exchanges more so than betting market platforms. You can profit by buying low—say, at $0.40—and selling higher at $0.60, for example. On certain platforms, that hinges upon a willing buyer, of course. You can also wait for the outcome to occur and collect your profits if your prediction was correct.

Prediction markets can be volatile. Prices can swing dramatically as new information or even unsubstantiated rumors surface. While this makes for great potential profit opportunities, it can also mean quick losses.

Before you buy a contract, make sure you read the fine print. Each contract has very specific settlement rules that dictate which outcome will be marked as successful.

What can you trade on?

Prediction markets owe their skyrocketing popularity, in part, to the sheer variety of things you can predict. While some prediction sites offer sporting outcomes, we’ll focus here on other areas.

Politics

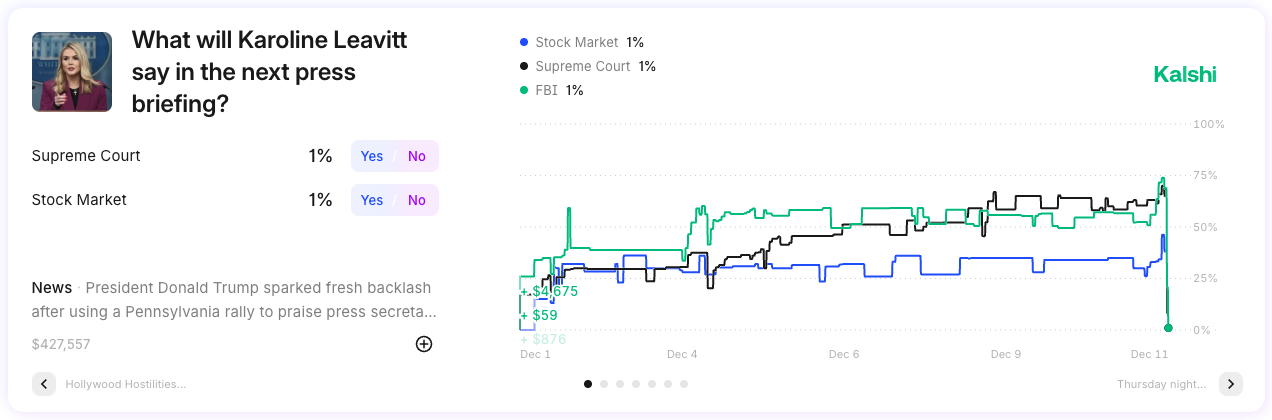

Prediction markets allow trading on political outcomes. The obvious ones in the US are election results, particularly in high-profile races like the presidential election or hotly contested Senate seats. Political betting markets extend beyond that to include party-based outcomes (who will control the Senate?), geopolitical happenings (will X country join this treaty?), or policy decisions (will Congress pass X bill this year?). Other forms of politics betting include debate outcomes, Supreme Court decisions, or even whether a specific politician will utter a certain phrase in an upcoming speech.

Pop culture and entertainment

Pop culture is ripe with trading opportunities at prediction market platforms. Markets at the time of this writing included movie profits (will the third Avatar film gross over $1 billion in its first month?), Oscar nominations, songs reaching more than 1 billion streams, and others. (Think of it like a Hollywood stock exchange.)

You can dig even deeper to find slightly more niche markets like Clair Obscur’s likelihood to win Game of the Year.

Weather and natural events

Weather events are increasingly popular among prediction traders. Featured markets can include predicted snowfall in a given month (10.0 inches or over vs. fewer than 10.0 inches, for example), temperature highs and lows, or hurricane categorizations.

Financial and economic indicators

Prediction markets have roots in financial trading, so it’s no surprise you can find finance-based outcomes available. Outcomes can feature federal interest rates, the price of specific cryptocurrencies, stock market milestones, or corporate mergers.

Science and technology

Prediction Markets are powered by increasingly advanced technology, and they also enable trading on related outcomes. This category is broad, and it includes all sorts of markets. Think space missions, AI milestones, upcoming iPhone features, or exoplanet discoveries. The long-term nature of some of these markets means they have less liquidity than other types, but they are a remarkable reflection of public perception.

The legal landscape for prediction markets

Prediction markets are enjoying a renewed place in the public eye. While that’s good news for their popularity, it can also mean enhanced scrutiny. Let’s take a look at the current legal landscape and how it impacts prediction markets and people who want to use them.

First, let’s talk about federal regulation. Some prediction market platforms, such as Kalshi and Crypto.com, have Commodity Futures Trading Commission approval as official exchanges. Others, like Polymarket, are working to secure it. If you want to play at a trustworthy prediction markets platform, a CFTC approval is the first thing to look for.

However, there’s a wrench in those gears. Some state laws are murky about prediction platforms, and some lawmakers are eyeing the platforms for potential regulations or restrictions. New York and Connecticut have recently issued cease-and-desist letters to certain prediction market companies. These legal disputes (and others like them) are ongoing and will undoubtedly shape the legal landscape for prediction markets going forward.

Keep an eye on these developments in the gambling news. In the same way that states with legal online casinos have gone after sweepstakes casinos, you can understand how states with legal sports betting might have mixed feelings about sports prediction markets.

Political prediction markets have also been subject to additional scrutiny for fear of election integrity issues. Kalshi originally applied to offer political prediction markets in 2022, but the CFTC denied the application. In 2024, an appeals court ruled in Kalshi’s favor. This doesn’t necessarily mean political markets are in the clear. Instead, this paints an unclear picture for their future, especially amidst emerging criticism of prediction platforms as a whole.

Finally, there are some small-scale academic exceptions to prediction market laws. They usually apply to platforms that have low thresholds and maximums. One example at the University of Iowa limits traders to $500 and uses the platform for data collecting and educational purposes.

What does this all mean? It’s a confusing time to be a prediction market trader—that much we can acknowledge. But we can’t dole out legal advice.

Instead, we encourage you to do research and exercise caution. We only recommend sites that are operating with proper approvals, but these situations can and will change depending on lawmaker sentiment and passage of any future restrictions. Of course, the opposite could also happen, and the US could largely embrace prediction markets. Time will tell, but for now, play with a healthy dose of caution.

How prediction markets differ from sportsbook betting

We’ve covered a lot of the distinctions between prediction markets and online sports betting, but let’s take a minute to make them ultra clear. These differences are helpful to know whether you plan to participate in prediction markets, sports betting, or both.

Market vs. house

In sports betting, you’re competing against the house. The sportsbook sets the odds, which determine your potential winnings. IF you win, you get paid. If you lose, your bet is gone (and in the book’s coffers). Sportsbooks will try to balance odds and lines so they earn money regardless of the outcome, creating a house edge otherwise known as the vig or juice. This is the reason you hear the phrase “the house always wins.”

Peer-to-peer markets power prediction markets, and they’re significantly different. The platform matches predictors of opposing views to balance the trading prices. The “odds,” or potential payouts, are therefore determined by prediction activity. As the facilitator of these peer-to-peer transactions, a prediction market makes money on fees.

Trading vs. fixed betting

Place a bet at a sportsbook, and your odds are fixed at the time of the wager. In other words, if you bet on the Chicago Bears at +150, your odds will be +150 until the bet settles (even if they later change after you’ve placed the bet). You may be able to cash out early if the BEars start to lead, but in most cases you are locked in to your odds.

At the best NFL prediction sites, pricing works differently. You buy contracts at a price between $0.01 and $1 (purchasing multiple contracts is allowed for bigger potential wins or losses). If you choose, you can wait for the outcome to be revealed and collect $1 per contract if successful (or lose it all if unsuccessful). However, you have an alternative option. If you buy a contract at $0.20 and it later jumps to $0.55, you can sell it for that price and make a profit. At some prediction platforms, this requires a willing buyer to be available, so it’s not always guaranteed.

Breadth of outcomes

At a sportsbook, you’re likely to be betting on one of two or three outcomes, at least with standard bets like moneylines or point spreads. Props have some exceptions.

Sports prediction markets can have a similar structure, with simple “yes” or “no” contract options. More often, though, you predict outcomes from a longer list. For example, you can predict the winner of TIME’s Person of the Year distinction from a list of 5 or more potential candidates.

Regulatory footprint

Sportsbooks are only allowed to operate in authorized jurisdictions and under the oversight of a regulatory body. They must also pay hefty licensing fees and submit earnings reports to their overseers.

Prediction markets have yet to achieve that level of oversight, which necessitates some extra caution. While the CFTC approves some sites, others remain unregulated. This uneven legal ground sets the stage for future legal battles regarding the long-term efficacy of prediction markets.

It would also make sense for prediction sites to immediately adopt responsible gambling practices, even though it could get tricky in terms of the language they use. You’re still depositing money and making picks. Discretion will be hugely important.

How to evaluate a prediction market platform

Not all prediction sites are the same. When deciding which platform to use, keep the following factors in mind.

Regulation and legitimacy

Start by checking whether the platform is allowed to operate in the US and under what framework. CFTC-regulated exchanges generally offer more oversight, clearer rules, and stronger consumer protections than offshore or unlicensed sites. Look for transparency around licensing, terms of use, and ownership. If a platform is vague about where it is regulated, that is a major red flag.

Fees and settlement clarity

Every prediction market charges something, whether it is a per-trade fee, a slice of your profits, or withdrawal costs. Read the fee page before you deposit, and factor those costs into any strategy. Just as important, review how each market settles. Good platforms spell out their data sources, timing, and tie-breaking rules so you are not surprised when a close or controversial outcome is graded.

Liquidity and market depth

Liquidity tells you how easy it is to enter and exit a position at a fair price. Active markets have tight spreads between buy and sell offers and enough volume that your trades do not move the price much. Thin markets feel sticky, with wider gaps and limited order size. If you plan to trade frequently or risk larger amounts, healthy liquidity should be a top priority.

User experience, mobile experience, and data tools

A prediction platform should be intuitive to navigate, even if the underlying markets are complex. Clean layouts, clear labeling, and simple order tickets make a big difference for new users. Mobile apps matter too, since many traders check prices on the go. Extra tools like charts, historical prices, alerts, and watchlists help you make informed decisions rather than guessing from a single number.

Market selection and reputation

Consider both what you can trade and how the platform is perceived. Some exchanges specialize in economic data, others lean into politics, sports, or pop culture. Pick one that consistently lists markets you actually care about. Then do a quick reputation check: news coverage, community chatter, and how the site has handled past disputes or outages. A strong track record is worth more than one flashy promotion.

Final thoughts on prediction betting markets

Prediction markets are an intriguing and innovative space adjacent to real gambling. They are more akin to trading on the stock exchange, though, and their status in the US is still evolving. They’re certainly on the upswing right now as we see other forms of alternative gambling, like social casinos, take a pounding in the regulatory sphere.

Major positives of prediction markets include the ability to trade before an outcome settles, widespread availability (even in some non-gambling states), and the breadth of available markets, such as pop culture and politics. Cons include a shaky legal landscape with a lot of uncertainty and ongoing disputes with lawmakers.

At PlayUSA, we strive to keep up informed and up-to-date with the latest wagering and wagering-adjacent platforms. Prediction betting markets fall firmly into the latter space, so we encourage plenty of caution and research before you dive in. We will only ever recommend legal and regulated platforms and follow legal guidance as it becomes available.